10 Best Outsourced Accounts Payable Providers For Small Businesses

Missed invoices, duplicate payments, and payment fraud can all cause undue strain on your business growth. Smart companies know that they can reduce time, improve the strain on vendor relationships, and save money internally by using accounts payable outsourcing companies for their AP process.

Accounts payable outsourcing is different from accounts payable automation, in that it allows a little more human control over novel situations. There are some excellent and affordable companies that provide outsourcing accounts payable services.

If your business growth has brought you to the point where it’s time to use accounts payable outsourcing, the companies on the list below are the best that I’ve found for small companies.

- Bill.com – Best All-Around Accounts Payable Outsourcing

- Paymo – Best for Collaboration with AP Processes

- Papaya Global – Best for Security in Accounts Payable Outsourcing

- Corpay One – Best for (Mostly) Free Outsourcing Accounts Payable

- Beanworks – Best for Accounts Payable Process Efficiency

- Pilot – Best for Remote Teams & Global Contractors

- Remote – Best for Lowering HR Costs

- Melio – Best for Cash Flow Needs

- Bench – Best for Streamlining Your Accounting System

- Stampli – Best for Fast B2B Payments

Best Outsourced Accounts Payable Providers: Overview

Best All-Around Accounts Payable Outsourcing

I want to be perfectly candid and say that I use Bill.com for my work as an affiliate and marketing expert. They are first on my list because my personal and professional experience has been amazing using their accounts payable outsourcing services.

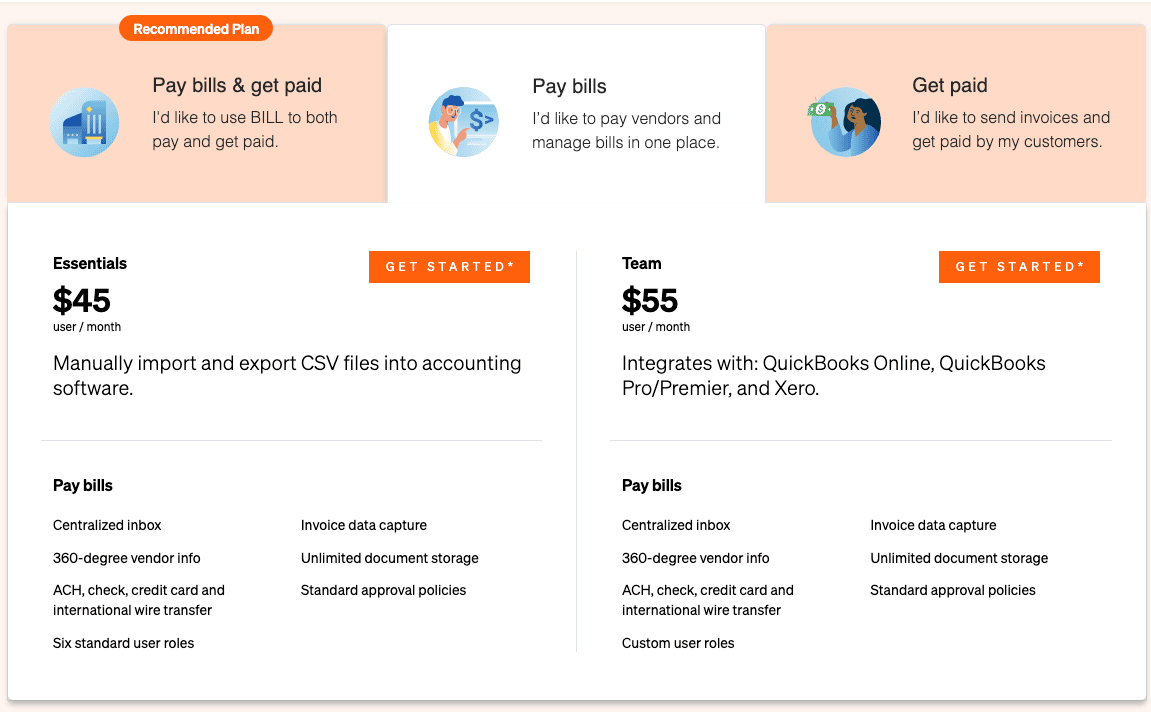

Pricing

Bill.com has several levels of pricing and each depends on what you want. Here is the pricing for accounts payable (AP) outsourcing:

- Essentials Plan: $45/user/month

- Team Plan: $55/user/month

There are also other add-ons available, such as paying bills or receiving money owed (accounts receivable).

Data Security

Using accounts payable outsourcing means trusting another company with some of your most sensitive financial data, and Bill.com knows that. Their AP process is built with security in mind, and includes the following data security measures:

- Multi-layered security

- AICPA SOC 2 compliance

- HIPAA compliance (if your company keeps medical records or data)

- No third-party issuers

- Secure data facilities with full redundancy

Customer Support

Bill.com offers live customer support from 5 am to 6 pm PST, Monday through Friday (excluding holidays). The website includes an extensive FAQ section and support forum, as well as live chat and phone support to reach customer service outside of normal business hours.

Star Rating

/ 5.0

Paymo is a collaboration tool built to help streamline work for teams within small and medium-sized businesses.

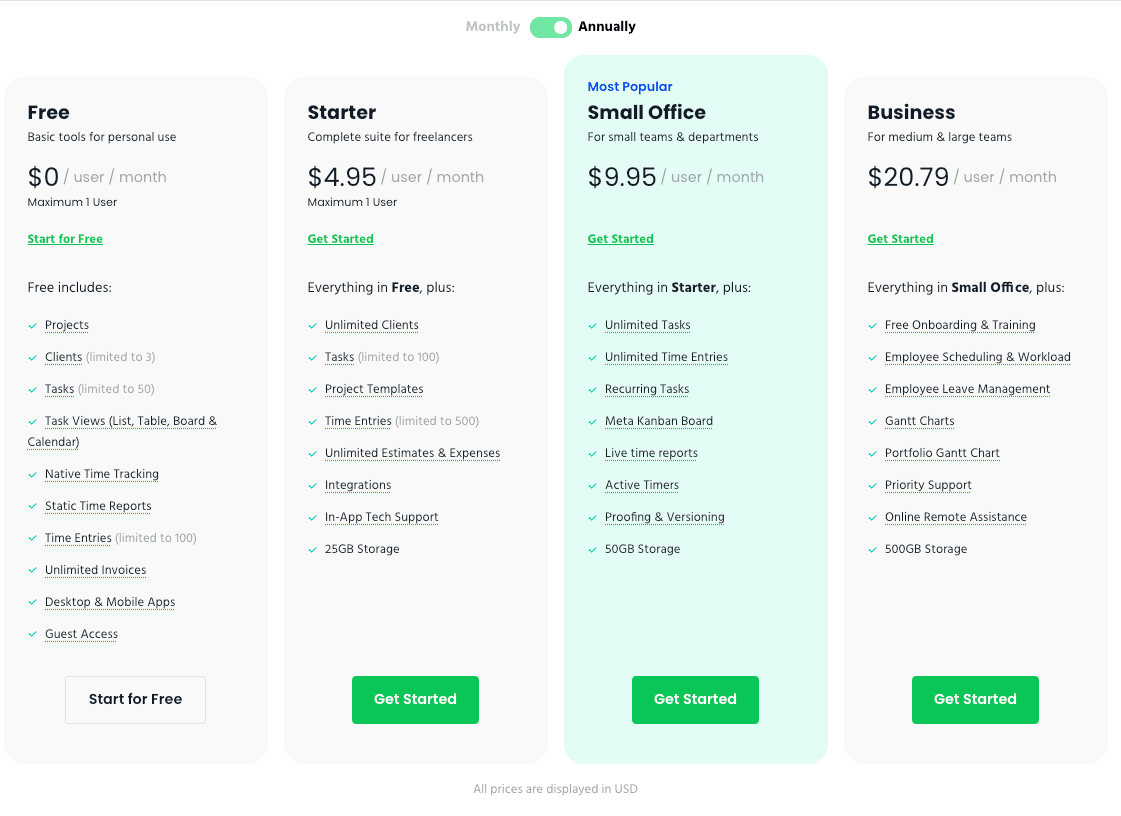

Paymo Pricing

Despite offering a wide suite of services, the cost savings for using Paymo for accounts payable (and a number of other things) could be remarkable.

- Free Plan: Only 1 user

- Starter Plan: $4.95/user/month for 1 user

- Small Office Plan: $9.95/user/month

- Business Plan: $20.79/user/month

Data Security

It is difficult to find information about their data security directly from this AP outsourcing company. Protective.ai reports that Paymo has zero security risks in its cloud security, meaning your data is safe in transit and storage.

Customer Support

Paymo offers many different ways for customers to find support when needed. The website has a Paymo community, where users can submit questions and help each other out. There is also a Paymo blog to answer FAQs in advance and a Paymo help page full of step-by-step guides.

The customer success team starts all new clients off with a 1:1 call for onboarding. You can also send an email directly to the customer support team through the website or contact them through the Paymo social media pages.

Star Rating

/ 5.0

Best for Security in Accounts Payable Outsourcing

Papaya Global is another option if you need someone to handle your company’s accounts payable functions.

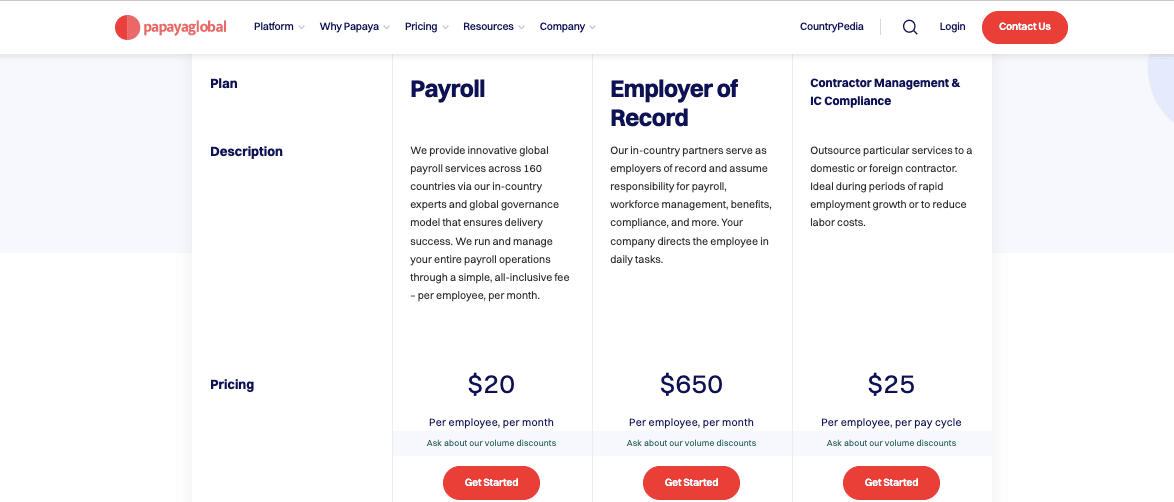

Pricing

Papaya Pricing

Along with the ability to supercharge your AP automation, Papaya Global also offers onboarding, HRIS, payroll, compliance, and cross-border payment services.

- Payroll Only: $20/employee/month

- Employer of Record: $650/employee/month

- Contractor Management & IC Compliance: $25/employee/pay cycle

Data Security

Papaya not only takes its data security seriously, but many security professionals choose the company because they know how safe their data is when outsourcing accounts payable to them. Here are some of the security benefits when using Papaya:

- Certified by Cloud Security Alliance (CSA)

- Listed in CSA’s STAR registry (Security, Trust, Assurance, and Risk)

- ISO 27001 and ISO 27701

- Hold SOC 1, Type 2, and SOC 2, Type 2 audit reports

Customer Support

There is always someone from team Papaya who is available to help with your outsource accounts payable. Here are some of the robust customer service options.

- 24/7 live reps

- Chat support

- Phone support

- Email-based help desk

- Knowledge base forum and customer forum

- Site FAQs

Star Rating

/ 5.0

Best for (Mostly) Free Outsourcing Accounts Payable

Corpay One calls itself “spend management” and specializes in helping fast-growing companies make their spending more efficient. They help to set up bookkeeping, streamline payments to your vendors, and allow you to manage your employees’ spend via custom controls. They also provide a Corpay Mastercard for your company and can assist with gaining lines of credit.

Pricing

The best part about Corpay One? It’s free with unlimited users, except for a few minor per-transaction fees:

- Check and ACH Payment via Credit Card: 2.9% of the transaction amount

- International Wire Payment: $9.50

Data Security

Protective.ai ranks Corpay One a 10/10 for its cloud security – noting good data protection and having a good security infrastructure in place. Corpay One also uses the highest level of data encryption for your bank information, utilizing Stripe for this.

Customer Support

Corpay One offers plenty of ways to contact their responsive customer support team. The team has live chat available from 9 am to 9 pm EST Monday-Friday, an email form on the customer support web page, and even a dedicated Slack channel for customers.

Star Rating

/ 5.0

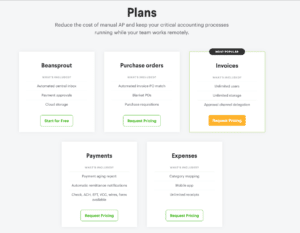

Best for Accounts Payable Process Efficiency

Beanworks provides automation processes for your AP processes that allow your accounting service team to collaborate and be far more cost-effective. They claim to reduce 83% of manual data entry, cut invoice processing costs by 86%, and strengthen your entire accounts payable processes using AI.

Pricing

Beanworks does not provide pricing on its site and requires a custom quote for new orders.

Beanworks Pricing

Data Security

Beanworks uses Amazon Web Services (AWS) for its hosting platform and SageAPA for the security infrastructure of its accounts payable functions. They also use Ubuntu/Linux for its internal servers and operating systems, which creates strong firewalls and antivirus protection.

Customer Support

The Beanworks customer service teams are broken into specific sections for any type of questions you may have. They also have robust FAQs and education sections on the site to help you understand their AP processes.

Star Rating

/ 5.0

Best for Remote Teams & Global Contractors

Pilot is built with remote teams in mind, saving you time by managing your payroll, benefits, and compliance all in one platform.

Pricing

Pilot’s pricing can seem a little steep, but if you are saving billable hours for multiple employees, it can be worth it.

- Contractors: $29/contractor/month

- Employees: $299/employee/month

- Employees Plus: $449/employee/month

Data Security

Despite being a marketing expert, I found it quite difficult to find any information regarding their data security or infrastructure.

Customer Support

Pilot provides a real-time chat box on its website and forum where AP outsourcing customers can submit questions.

Star Rating

/ 5.0

Best for Lowering HR Costs

Remote offers AP outsourcing, along with the ability to outsource your entire HR department.

Pricing

If you understand the benefits of outsourcing accounts and know how much this could essentially save, you understand the value. Speaking of value, their pricing is:

- Contractor Management: $29/contractor/month

- Employer of Record: $599/employee/month

- Global Payroll: Quote required

- Remote Enterprise: Quote required

Data Security

Here are some of Remote’s security highlights:

- Encrypts data both while in transit and at rest

- Follows least privilege principle for internal security

- Remote uses AWS for hosting, which provides the following data security standards:

- SOC 1,2,3

- ISO 27001/27017/27018

- PCI-DSS

Customer Support

Remote offers 24/7 support through the help@remote.com email address, in addition to a chatbot on the website and help forums with answers from the community.

Star Rating

/ 5.0

Best for Cash Flow Needs

Melio only offers solutions for your AP department, unlike many others on this list who try to do it all. The difference is that Melio is affordable because they only focus on outsourcing AP.

Pricing

Melio provides you the ability to pay in any format you prefer based on your cash flow, and they will pay the vendor invoices in any method they prefer.

There is no charge for the software, but certain AP functions will cost you:

- Paper Checks (first two per month are free): $1.50

- Credit Card Payments: 2.9% transaction fee

- Debit Card Payments: 2.9% transaction fee

- Same-Day Bank Transfers: 1% fee

- Expedited Check Delivery: $20

- International Same-Day USD Transfers: $20

Data Security

Melio provides several layers of security for every step of their accounts payable solution:

- State-of-the-art cryptographic algorithms during data transmission

- Servers located in PCI and SOC 1, 2, and 3 certified data centers with 24×7 monitoring

- Funds are held in a protected account until delivered

Customer Support

Melio offers an FAQ section, a blog to help you understand the platform better, a help forum, and an email form to send a message to customer support.

Star Rating

/ 5.0

Best for Streamlining Your Accounting System

Bench does not provide the ability to outsource your accounts payable department, but they do provide an amazing suite of accounting services that can streamline your accounting operations and bookkeeping.

Pricing

Here are some of the pricing details for Bench:

- Essential Plan: $249/month

- Premium Plan: $399/month

Data Security

- SOC 2 compliant

- A rigorous screening process for employees

- Bookkeeping is kept entirely in-house

Customer Support

Bench provides resources for customer education, including guides to familiarize you with the platform, an FAQ section, and a chatbot on the website.

Star Rating

/ 5.0

10Stampli

Best for Fast B2B Payments

Stampli aims to make your B2B payments a breeze, facilitating your payments directly through your bank via ACH. They want to make your accounts payable processes fast and simple, saving you a headache on payments.

Pricing

Stampli offers month-to-month pricing (with no annual contract) but requires a consultation with their sales team for a price quote.

Data Security

Stampli includes a privacy policy on their website for your data, but I couldn’t find any information on their website or online regarding their specific data security practices.

Customer Support

Stampli has various help system articles and an email form to reach customer support.

Star Rating

/ 5.0

What Are the Main Services of an Outsourced Accounts Payable Provider?

Accounts payable processes can become backed up and riddled with errors due to duplicate invoices, data entry errors, and even payment fraud if a rapidly-growing company isn’t careful.

Outsourced accounts payable providers often help streamline your AP department by providing some of the following additions to your accounts payable process:

- Invoice processing

- Invoice matching

- Processing purchase orders

- Processing debit memos

- Removing manual data entry errors

- Streamlining payments

- Double-checking any invoice receipt

- Streamlining your business rules

- Enhancing reporting tools

- Increasing operational efficiency

- Reducing overhead expenses

What Are the Benefits of Outsourcing the Accounts Payable?

Outsourcing your AP may seem expensive at first glance, but an honest weighing of the benefits may show that it can be cost-effective in the long run. Here are some of the benefits of outsourcing your accounts payable:

- Increased uptime and accountability

- Efficient administrative, tracking, and reporting tools

- Increased resources in addition to your in-house AP department

- Reduced cost for your AP process

Why Are Companies Outsourcing Accounts Payable?

Here are some of the common reasons why a company would outsource its AP department:

- Your AP team is overwhelmed

- You have high invoice processing costs

- Your AP process lacks control

- Cost savings to outsource rather than hire more in-house AP staff

What are the Challenges With Outsourcing the Accounts Payable?

It’s not all sunshine and rainbows. Here are some of the challenges you may expect with outsourcing accounts payable:

- Loss of control

- Dependency

- Less flexibility for your operations

- Potential errors

- New line of communication required

How to Choose the Right Outsourced Accounts Payable Provider

Of the ten best outsourcing accounts payable companies listed above, how do you choose the right one? Each of those listed above is titled as “best” for a certain function, and if that is what you are looking for, it may be the right choice for you.

If none of those fit your needs exactly, here are the factors you should consider:

- Price

- Automation vs human control

- Streamlining

- Customer reviews

- Ease-of-use

- Data security (your industry may have specific requirements)

Bottom Line

There are ten different accounts payable outsourcing companies listed in my review above, and each specializes in different functionality. As I outlined at the beginning of my review, I personally use Bill.com and it is my favorite from my experience.

Some of those listed above are free to use except for a few line-item charges, while others provide an entire suite of services beyond just AP operations. Use the list above to find the one that is right for you, and start driving efficiencies where it counts – with your money!